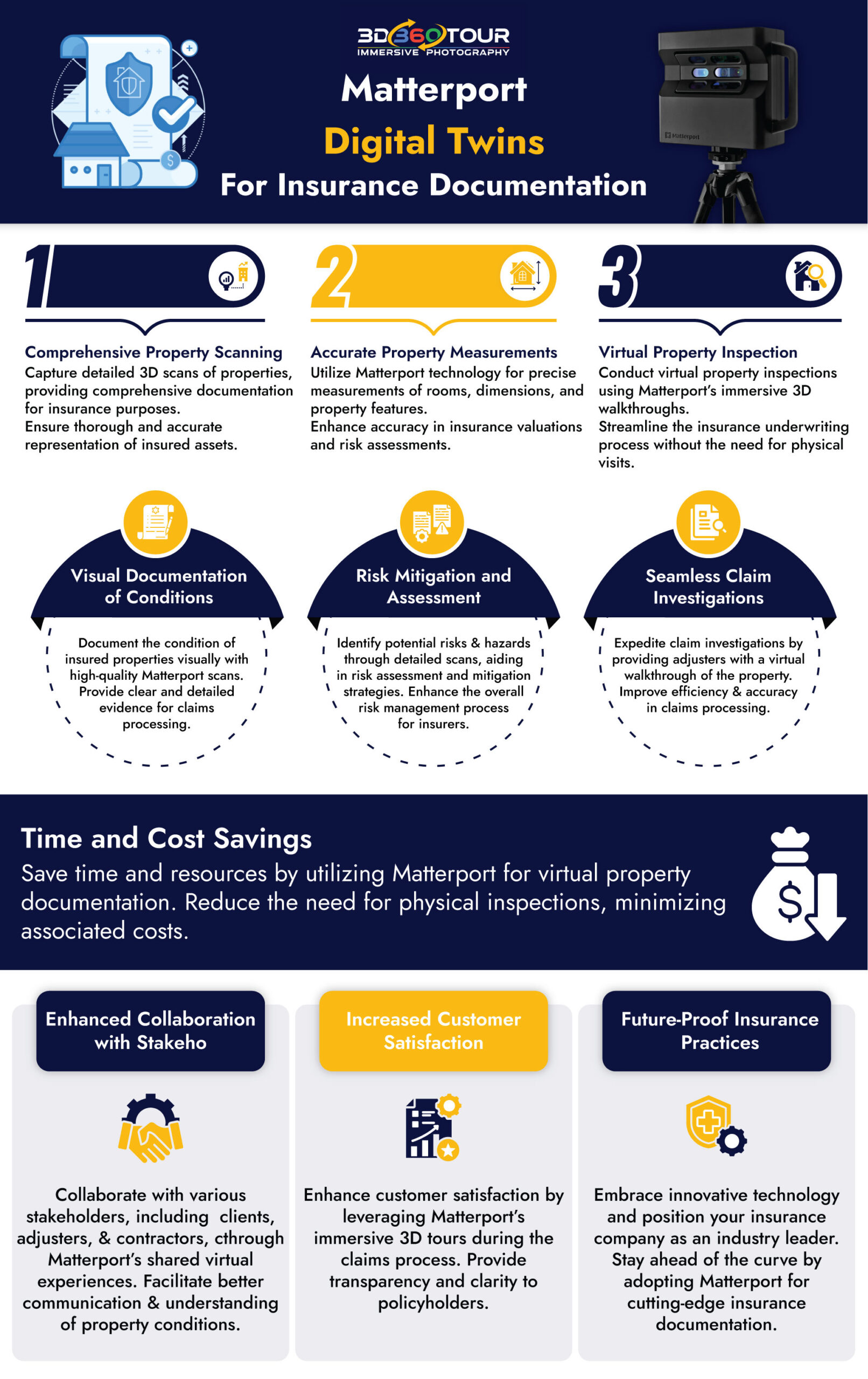

Digital Twins for Insurance Documentation

The Benefits of Matterport for Streamlined Insurance Documentation

In the ever-evolving landscape of insurance documentation, technology continues to play a pivotal role in enhancing efficiency and accuracy. Matterport, a cutting-edge 3D technology, is revolutionizing the way insurance professionals document properties. Let’s explore the myriad benefits of integrating Matterport into the insurance workflow.

1. Comprehensive Property Assessment: Matterport allows insurance professionals to conduct thorough property assessments remotely. With its 3D scanning capabilities, Matterport captures every detail of a property, providing a comprehensive visual documentation that can be crucial for insurance underwriting and claims processing.

2. Accurate Risk Assessment: Accurate risk assessment is fundamental in the insurance industry. Matterport’s precise measurements and detailed imaging enable insurers to assess risks more accurately. This comprehensive data minimizes the likelihood of underestimating or overestimating the value of a property, contributing to more precise policy pricing.

3. Virtual Property Inspection: Traditional property inspections can be time-consuming and may involve travel to different locations. Matterport allows insurance professionals to conduct virtual property inspections, saving time and resources. Inspectors can navigate through the property remotely, capturing all necessary information without the need for a physical visit.

4. Enhanced Claims Processing: In the event of a claim, having a Matterport 3D scan of a property proves invaluable. Adjusters can remotely assess the damage by virtually touring the property, expediting the claims processing timeline. This results in faster resolution for policyholders and more efficient claims management for insurance companies.

5. Documentation for Underwriting: Matterport provides a wealth of visual documentation that is invaluable for underwriting purposes. Insurers can access detailed imagery of a property’s condition, layout, and features, facilitating more informed underwriting decisions. This enhanced documentation reduces the risk of discrepancies and ensures accurate policy issuance.

6. Remote Collaboration: Matterport’s cloud-based platform facilitates seamless collaboration among insurance professionals, even when working remotely. Teams can collectively review 3D scans, share insights, and make collaborative decisions, leading to more efficient workflows and improved communication.

7. Reduced Liability: Accurate and comprehensive documentation is a powerful tool in reducing liability for insurance companies. Matterport’s 3D scans provide a visual record of a property’s condition at a specific point in time, helping insurers demonstrate transparency and accuracy in their assessments.

8. Competitive Advantage: Insurance companies adopting Matterport gain a competitive advantage by leveraging state-of-the-art technology. This not only enhances operational efficiency but also positions the company as an industry leader committed to utilizing innovative solutions for the benefit of both insurers and policyholders.

Conclusion: Matterport is transforming the landscape of insurance documentation by providing a sophisticated and efficient way to capture, document, and assess properties. From comprehensive property assessments and accurate risk evaluations to streamlined claims processing, the benefits of Matterport extend across the insurance workflow. Embrace the efficiency of Matterport and revolutionize your insurance documentation processes for a more accurate, transparent, and competitive approach in the industry.